Examine This Report on Pvm Accounting

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.Facts About Pvm Accounting UncoveredThe Greatest Guide To Pvm AccountingOur Pvm Accounting StatementsPvm Accounting Can Be Fun For EveryoneSome Of Pvm Accounting

Look after and manage the creation and authorization of all project-related billings to consumers to promote excellent interaction and prevent issues. construction taxes. Make certain that suitable records and documentation are sent to and are upgraded with the internal revenue service. Make sure that the audit process abides with the law. Apply needed construction accountancy criteria and procedures to the recording and reporting of building and construction activity.Connect with various financing agencies (i.e. Title Company, Escrow Firm) pertaining to the pay application process and needs required for settlement. Assist with applying and maintaining internal economic controls and treatments.

The above statements are meant to describe the general nature and degree of job being done by individuals designated to this classification. They are not to be understood as an exhaustive list of responsibilities, tasks, and abilities needed. Personnel may be called for to perform duties beyond their typical obligations once in a while, as needed.

Examine This Report about Pvm Accounting

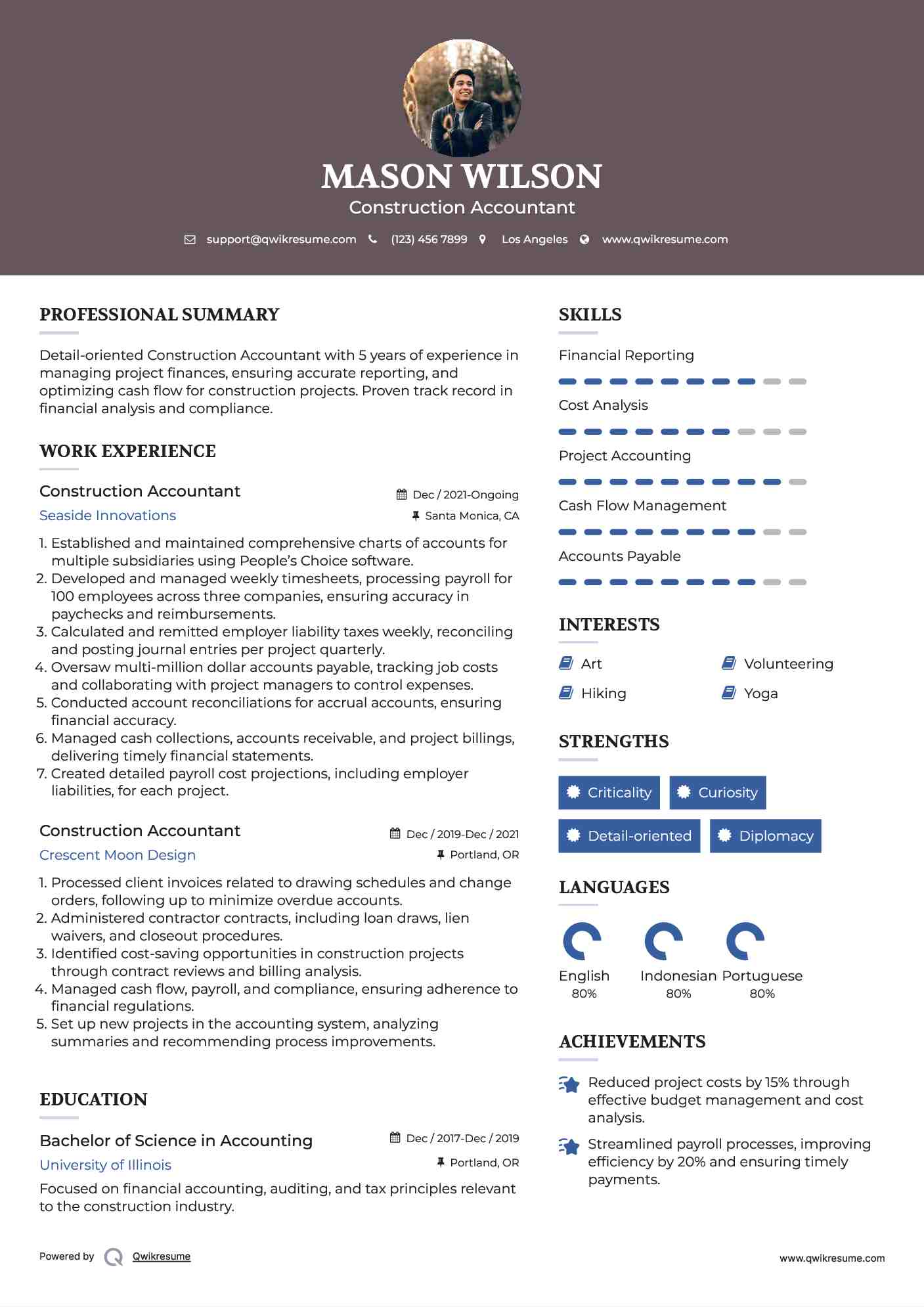

Accel is looking for a Building Accounting professional for the Chicago Office. The Building Accounting professional executes a range of audit, insurance conformity, and job management.

Principal duties include, however are not restricted to, taking care of all accounting functions of the company in a timely and precise fashion and providing reports and routines to the business's certified public accountant Company in the prep work of all financial statements. Guarantees that all accountancy procedures and features are taken care of properly. Liable for all financial records, payroll, banking and everyday operation of the accountancy function.

Functions with Job Managers to prepare and upload all regular monthly invoices. Creates regular monthly Job Price to Date reports and functioning with PMs to fix up with Project Supervisors' budgets for each task.

The Basic Principles Of Pvm Accounting

Effectiveness in Sage 300 Construction and Actual Estate (formerly Sage Timberline Office) and Procore building monitoring software an and also. https://giphy.com/channel/pvmaccounting. Must additionally excel in various other computer software program systems for the preparation of records, spread sheets and other audit analysis that might be required by administration. construction taxes. Have to possess solid organizational skills and capacity to focus on

They are the economic custodians that guarantee that building and construction projects remain on budget, abide by tax obligation regulations, and preserve monetary transparency. Building and construction accounting professionals are not just number crunchers; they are calculated companions in the building and construction process. Their main function is to take care of the economic elements of building and construction tasks, ensuring that resources are my site assigned effectively and financial dangers are lessened.

Not known Facts About Pvm Accounting

They work closely with task supervisors to create and keep track of budgets, track expenses, and projection monetary needs. By preserving a limited hold on project finances, accountants help protect against overspending and economic obstacles. Budgeting is a keystone of successful building and construction tasks, and construction accounting professionals are crucial in this respect. They develop thorough spending plans that incorporate all job expenses, from materials and labor to authorizations and insurance coverage.

Navigating the facility web of tax laws in the building sector can be challenging. Building and construction accountants are fluent in these regulations and make sure that the project adheres to all tax obligation requirements. This consists of handling payroll tax obligations, sales tax obligations, and any kind of various other tax obligation obligations certain to building and construction. To stand out in the duty of a building accounting professional, people need a solid academic structure in bookkeeping and financing.

Furthermore, accreditations such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Expert (CCIFP) are very regarded in the industry. Working as an accountant in the construction market includes a special collection of difficulties. Building jobs commonly entail limited due dates, altering policies, and unforeseen costs. Accountants should adapt quickly to these difficulties to maintain the task's economic wellness intact.

What Does Pvm Accounting Do?

Specialist accreditations like certified public accountant or CCIFP are likewise highly recommended to show proficiency in building bookkeeping. Ans: Construction accounting professionals develop and keep an eye on budget plans, identifying cost-saving opportunities and making certain that the task stays within budget. They additionally track expenditures and forecast financial demands to stop overspending. Ans: Yes, building accounting professionals handle tax obligation compliance for building jobs.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make challenging options amongst several economic options, like bidding process on one project over one more, picking funding for materials or devices, or setting a project's revenue margin. In addition to that, building and construction is an infamously volatile industry with a high failure price, sluggish time to repayment, and inconsistent capital.

Manufacturing involves repeated processes with quickly recognizable prices. Manufacturing calls for various procedures, materials, and tools with differing costs. Each job takes location in a new area with differing site conditions and distinct obstacles.

An Unbiased View of Pvm Accounting

Lasting connections with suppliers ease arrangements and enhance efficiency. Inconsistent. Constant usage of various specialized specialists and distributors influences performance and cash circulation. No retainage. Payment arrives in complete or with normal settlements for the full agreement quantity. Retainage. Some portion of payment might be held back up until project completion even when the professional's work is completed.

While conventional makers have the advantage of controlled environments and enhanced production processes, building and construction business have to continuously adjust to each brand-new task. Even rather repeatable projects need alterations due to site problems and other elements.